The Contractors State License Board (CSLB) licenses and regulates more than 285,000 contractors in the state of California. All contractors are required to carry the contractor license bond that is available at California Contractor Insurance Services.

Unlicensed contractors do not carry the contractor's bond, thus consumers do not receive protection from the bond insurance requirement. The CSLB receives nearly 20,000 complaints regarding unlicensed contractors annually. Contracting without a license is a crime punishable by fines and imprisonment (Business & Professions Code 7028).

The CSLB’s Statewide Investigative Fraud Team (SWIFT) performs monthly sting operations throughout California, resulting in hundreds of citations and usually three to five felony charges with each successful sting. Typically, each year the CSLB helps recover nearly $50 million in ordered restitution for consumers. We encourage all consumers to check a contractor’s license status with the CSLB prior to accepting the contract.

How can California Contractors Insurance Services help?

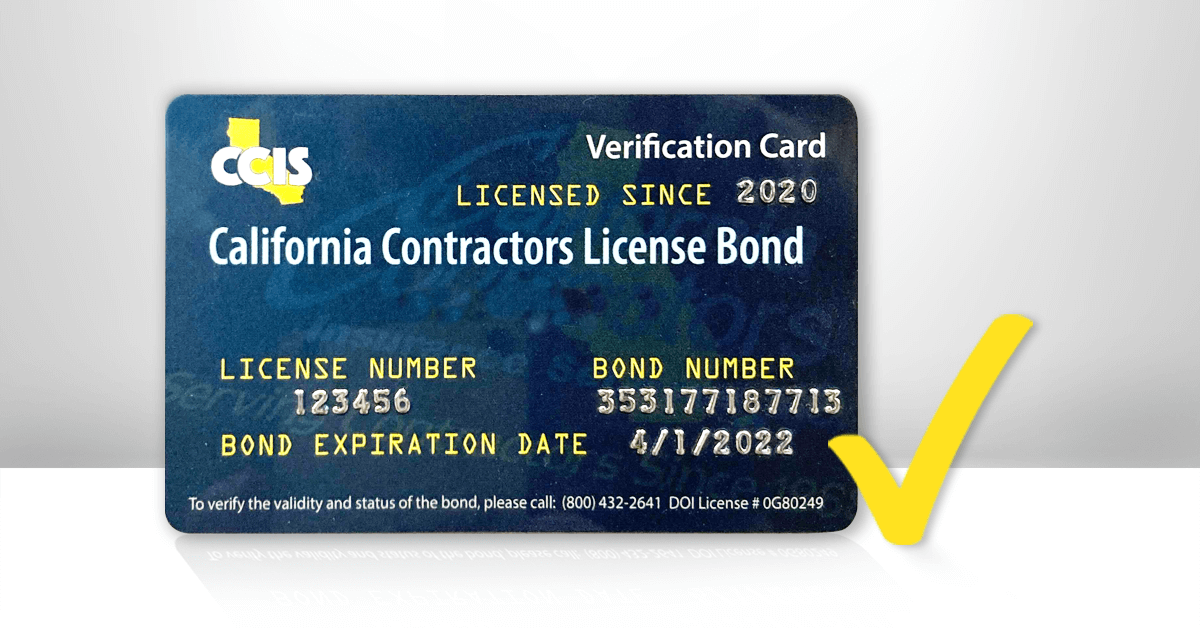

The required California contractor bond is our specialty. CCIS has been in business longer than any other California contractor-focused insurance agency. We work with several major insurance carriers to quickly deliver the lowest bond price available.

Contractors are required to file a $25,000 Contractor License bond with the California CSLB to maintain an active license. The bond protects the CSLB by transferring to a surety bond company the cost of damages to the public resulting from a licensed business breaking California’s Contractor License Law.

How much does a Contractor License Bond cost in California?

The bond costs depend on the personal credit, license history, and classification of the contractor.

| Price Tier | Bond Cost* |

|---|---|

| Ultra-Preferred | $109 |

| Preferred | $165 |

| Standard | $275+ |

| Credit Repair | $1500+ |

*Prices shown are for the one year term and are based on several factors including personal credit, license history, years in business, and active licensing and bonding. Not all available pricing tiers are shown. Rates do not constitute an offer of bonding and are subject to change at any time.

How does a California Contractor License Bond work?

The Contractor License Bond must be issued by an insurance carrier admitted by the California Department of Insurance. The insurance company issuing any surety bond will also be referred to as the “surety company” or the “bond company”. Contractor License Bonds refer to the contractor as the principal, the surety bond company as the obligor, and the CSLB as the obligee.

The surety company provides the CSLB a guarantee (the surety bond) that the customers, vendors, suppliers, and employees of a licensed contractor will receive payment for financial damages due to a violation of California Contractor License Law, up to a limit of $25,000 (“penal sum” or “bond amount”). The bond company also directly receives claims from the public and determines the validity of claims. Ultimately, contractors are responsible for their actions and required by California Contractor License Law to reimburse the surety company for any payments made under the bond or they'll face indefinite license suspension.

Violations triggering a bond payout may include a contractor failing to pay employees or vendors, abandoning an uncompleted job or failure to repair faulty workmanship.

Is a credit check required for California Contractor License Bonds?

Surety carriers will run a credit report as part of underwriting because the contractor ultimately must reimburse the surety bond company in the case any claims are made on a bond. The credit check is a soft check, which will not impact your credit score. California Contractors Insurance Services works with several surety bond companies with varying risk appetites, allowing contractors with poor credit to purchase the bond for the lowest rates available in the marketplace.

How does the wording of the California Contractor License Bond form impact the cost of the bond?

The bond is relatively favorable to the surety company, lowering the cost of the bond on balance. As detailed in the broader article on contractor license bonds, the primary text to consider surrounds (1) aggregate limits, (2) cancellation provisions, and (3) forfeiture clauses. The bond contains a $25,000 aggregate limit, a standard 30-day cancellation provision, and does not contain any forfeiture clause. Further, the bond form specifically references California statutes related to contractor licensing clearly granting the surety company the right to recovery from the contractor on bond payouts.

How do consumers check a California contractor’s license and bond?

Contractors in California are licensed and regulated by the CSLB, a division of the California Department of Consumer Affairs. To check the status of a contractor’s license and surety bond you can visit the CSLB website and enter the contractor's license number after clicking “Check a Contractor's License”.

What other types of surety bonds are required of contractors in California?

While all licensed California contractors are required to carry a $25,000 Contractor License Bond, certain contractor licenses may require a $25,000 Bond of Qualifying Individual, a $100,000 LLC Employee/Worker Bond, or a Disciplinary Bond depending on their license status. Contractors may also be required by the owner of a project to provide a Bid, Performance and Payment bond, often referred to as Contract Bonds, on a job by job basis. Not a California contractor? Then check out jetsurety.com to get a bond quote, they specialize in car dealer bonds.

How can insurance agents obtain a California Contractor License Bond for their customers?

California Contractors Insurance Services works exclusively with contractors for all of their business-related insurance needs. If you’re an insurance agent looking for an efficient platform to access quotes and purchase bonds for your contractor clients from dozens of surety carriers, we recommend The Bond Exchange. Licensed in 50 states, The Bond Exchange has been helping insurance agents with their surety needs for over 40 years, developing an extensive database of over 10,000 unique bond requirements.